Here you’ll find answers to some of the most common questions about tracking your crypto investments and market statistics. Because there is a lot of information, we have a separate section on our website where you can find more detailed explanations of the different indices: Balance your Crypto.

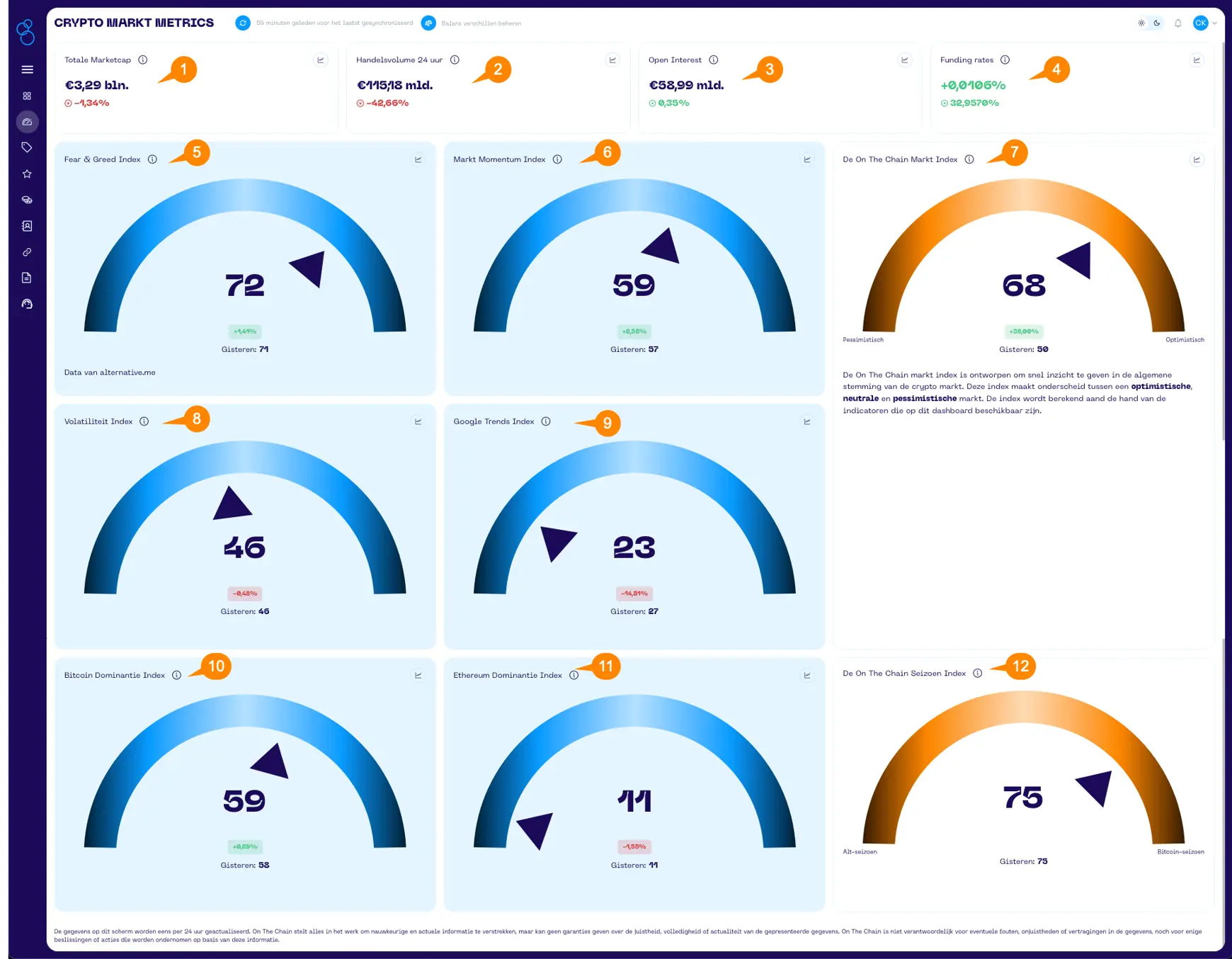

Learn how to interpret the various metrics to better understand the market situation and refine your strategies. Our dashboard provides a comprehensive overview of important indicators like the Fear & Greed Index, Bitcoin Dominance, and the On The Chain Market Index. If your question isn’t here, feel free to contact us via the support form.

)